According to Annuity.org, 75% of American teens lack confidence in their knowledge of personal finance.

When Americans reach the age of 18, they are officially considered an adult, which now means they have the option to be on their own, and make their own choices. Of these choices, many of them will be related to their finances. However, without proper financial knowledge, how are young adults meant to make wise decisions?

“I really wish I knew more about investing my money and earning credit. After having to buy a car a couple months ago it was really challenging for me since I wasn’t sure how credit worked or how to get a better credit to have an ‘easier’ time making important purchases,” shared Oakdale alum Hannah Puryear.

The biggest challenge many people find: the digital divide.

When most teachers were younger, they learned about how to write a check, budget, and save their receipts to track their spending. They dealt with financials in a paper format. However, over the last decade, a variety of digital banking apps have risen.

For older generations, using pen and paper to track and manage money is what they know and practice.

For younger generations, banking apps make depositing a check easier, although it doesn’t do them any good if they don’t understand the terms being used and how to responsibly make certain decisions. These kids are left with the questions: How do they pay a bill? How do they write a check?

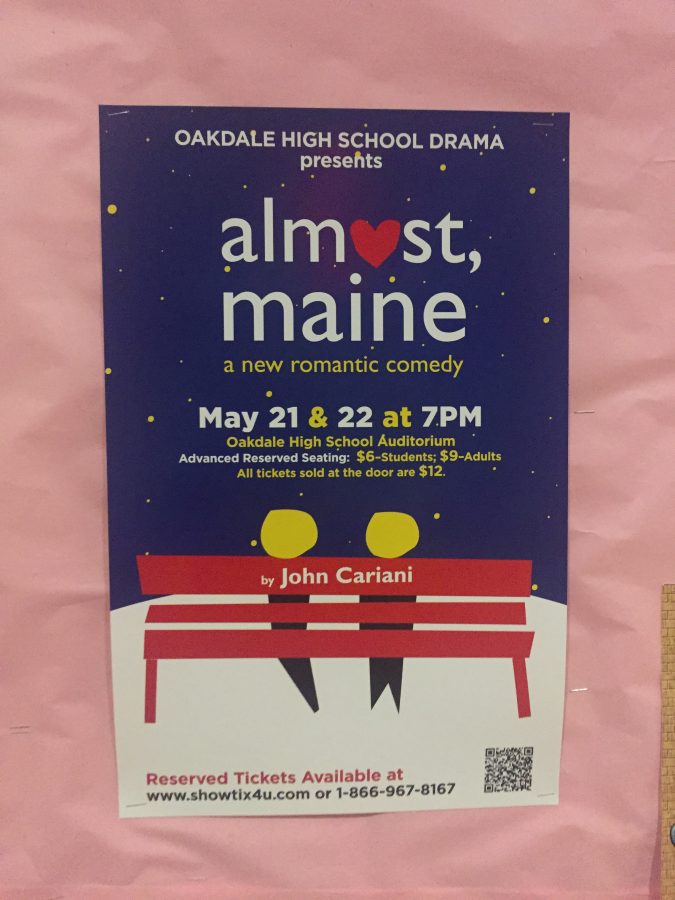

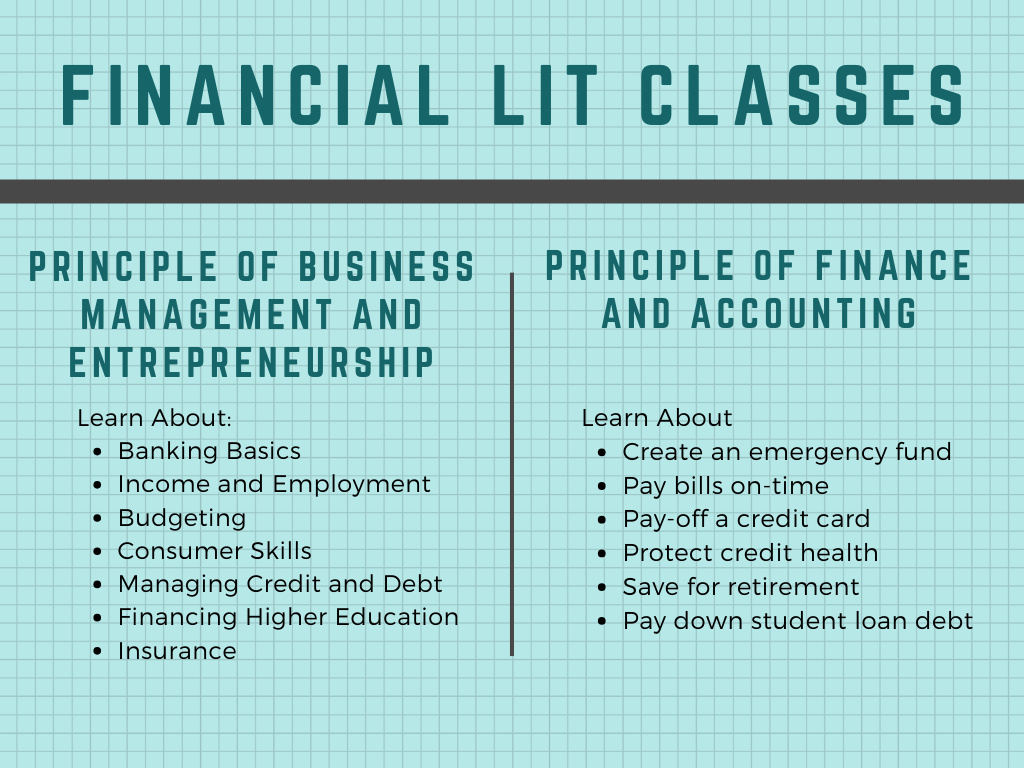

Considering students spend 18.5% of their time in school, Oakdale wants to help kids understand more concepts of finance, offering classes to help introduce students to the idea of finance.

“We have a lot of classes at OHS that offer financial literacy. Most are in the Career & Tech. Ed. department and include: Principles of Business Management & Entrepreneurship, Principles of Finance & Accounting, Learning Environment for Preschoolers, Intro to Ag. Science & Tech., Career & College Prep and Managing Your Personal Finances (.5 credit, juniors only),” Oakdale High business teacher Kaelyn Stieg shared.

“Like many others, I had very little, if any, financial obligations in high school so managing my finances weren’t something I was very concerned about,” Puryear explained. The financial literacy credit is pushed onto students at such a young age, that it is hard for them to care because they can’t relate it to their life. Many kids take this class in their freshman or sophomore year, but most of them also don’t have a job. Without a job, they most likely aren’t making money, which makes it hard for them to connect their learning to their personal life.

Even if students don’t have enough room in their schedule to take classes at the school, they can always learn through Frederick County Virtual School, by watching YouTube videos, or even taking classes at a local community college.

“I always say to take control of your money, or your money will control you,” stated Catherine Codd, another OHS business teacher.